Did you know, that in order to rent your DC property to tenants, it is required by DC law to acquire a Basic Business License? This information tends to come as a surprise to many homeowners, especially if this is your first rental experience. The process itself takes a bit of time, paperwork, and coordination between 3 different DC government agencies. If you are a client of Nomadic Real Estate, you are in luck! We take on the legwork of coordinating between our in-house inspection team and each relevant governmental agency to get a Basic Business License for your DC rental property.

Doing General Business In Washington DC: The Necessity Of A BBL

If you aim to set up shop or expand existing operations into America’s capital city—be it real estate management or leasing properties—a DC business license should be high on your list of priorities. This crucial document ensures that businesses comply with safety codes and tax obligations specific to doing general business in Washington DC. It safeguards entrepreneurs’ interests as well as those who interact with them from potential frauds associated with unlicensed entities.

The Road To Getting Your Basic Business License

- Determining The Need For A BBL:

Your operation might not require this certification based on its nature, size, type, etc., so checking its necessity becomes important before proceeding further. - Gathering Necessary Documentation:

You’ll need personal identification documents like a passport or driver’s license, along with proofs indicating operational readiness such as lease agreements, etc. - Filing The Application:

Once all relevant documents have been collected and checked for completeness and correctness, the application needs to be submitted either online via the DC Government’s Official Online Portal or physically at designated government offices.

How to Obtain a Basic Business License DC

Online Application and Fee Payment

The very first step in acquiring your Basic Business License (BBL for short) is to fill out the BBL online form provided by the Department of Consumer and Regulatory Affairs (also referred to as DCRA, for short).

Submitting your license application online simplifies the process significantly. You can provide all the necessary documentation without the need to physically visit any agency offices, making it efficient, quick, and hassle-free.

For the rental property, you must provide details such as its address, square footage, and unit count to complete the application form accurately. Accuracy is crucial here, as mistakes could lead to delays or even the denial of your BBL request. Therefore, double-check everything before submitting the form.

Once you have completed the form, the next step is fee payment. Yes, there is a cost associated with applying for each BBL issued by DCRA, which is also known as the basic business license DC residents are required to pay when renting their properties.

The cost of obtaining a BBL from DCRA can differ depending on elements such as the size and kind of rental property.

So, how do you determine the exact amount you should be paying? This is where official resources come into play.

DCRA provides detailed fee schedules that will help you determine precisely what costs apply in your case.

It is important to note that these payments are non-refundable, whether or not leasing activities actually commence post-approval.

Additionally, do not forget about other potential expenses, such as inspection charges and third-party endorsements. It is always a good idea to budget extra to be on the safe side.

After you’ve paid the fees, hang tight for approval before you start your leasing activities in DC. Make sure everything’s on the up and up to avoid any hiccups.

Clean Hands Self Certification

The next step in acquiring your Basic Business License is to fill out the Clean Hands Form. What this does is, it essentially tells the government that you are cleared of owing substantial amounts of money in taxes, parking fees, or any other types of government-issued fines.

Mastering Registration with the Office of Tax and Revenue

This might seem complex, but it’s quite straightforward when you understand the process. One key step is registering your property with the District’s Office of Tax and Revenue (OTR). This critical move sets up your tax account, allowing you to meet all financial obligations linked to owning real estate within the district.

The Nitty-Gritty: Filling Out Form FR-500

When it comes to successful tax registration, knowing how to correctly fill out Form FR-500 is paramount. The form has multiple sections that require accurate details about your business or property.

Provide your business’s identifying details, such as legal name, trade name (if applicable), social security number or employer identification number (EIN), and physical address, among others. Make sure these details are consistent with those on record at other government institutions like the IRS because discrepancies can lead to future complications.

The following sections ask for specific aspects related to your business activities, such as the type/nature of the conducted activity and expected annual gross receipts. Be truthful while filling out these fields since misleading information could result in penalties down the line.

Navigating OTR’s Online Portal: A Walkthrough

Beyond submitting a paper version via mail or hand-delivery at an OTR office location, homeowners have another option – using the MyTax.DC.gov portal to file their applications electronically, including Form FR-500 submission. This web-based system offers 24-hour access and provides immediate confirmation upon submission, adding convenience and speed to the application process. However, make sure to carefully read all instructions provided before starting the procedure to avoid errors and missteps along the way.

This electronic platform not only provides efficiency but also offers real-time updates regarding status changes relating to user accounts, ensuring transparency between taxpayers and local authorities. The District of Columbia Government’s regulations concerning the possession and running of residential and commercial buildings within Washington D.C.’s limits can be easily monitored with this system, helping to ensure that everything is in accordance with what is required.

Decoding Rent Control and Exemption Filing in Washington DC

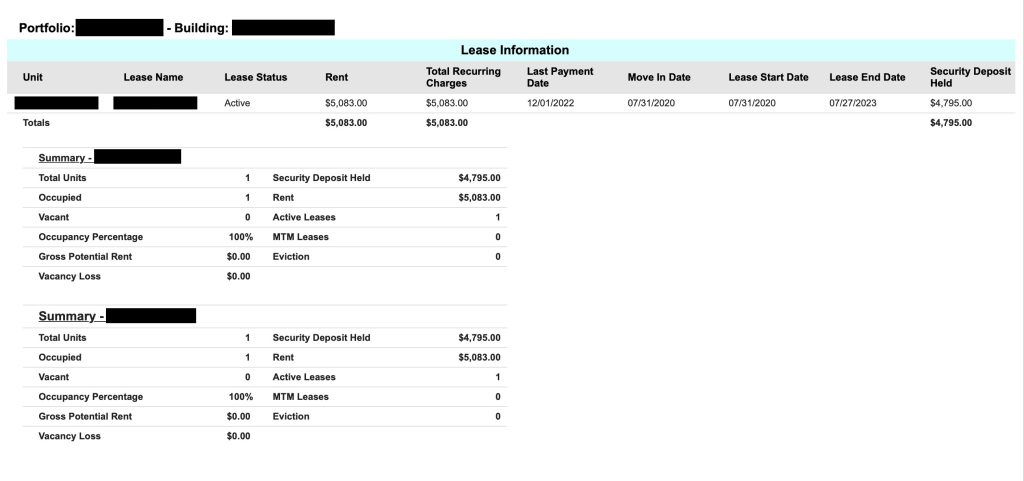

The Department of Housing and Community Development requires any landlord renting out a residential property to file for rent control. If a property is less than 3 units, you would need to file for a rent control exemption.

In the realm of property management, particularly in Washington DC, navigating rent control or exemption filings is crucial. The laws surrounding these business activities can be complex but are vital for any landlord renting out residential properties.

For landlords with fewer than three units, exemption from standard rent controls may be available, allowing for more flexibility in setting rental rates and ensuring regulation of the real estate industry. This not only offers flexibility when setting rental rates but also maintains regulatory oversight within the real estate sector.

Navigating Rent Control Laws

The landscape of rent control regulations isn’t universal across all types of properties. Therefore, understanding your obligations based on the nature and size of your property becomes essential to ensure compliance with local laws.

This involves familiarizing yourself with the resources provided by the Department of Housing and Community Development (DHCD). Landlords can access detailed procedures on filing their properties either as subject-to-rent-control or exempt-from-rent-control based on specific criteria set by DHCD.

Tackling Exemptions

A silver lining exists for those managing properties with fewer than three units: potential eligibility for a rent control exemption. However, this doesn’t mean bypassing regulation entirely – it merely alters how these rules apply to your leasing operations within the Washington DC area.

- Assess Eligibility:

Before initiating any filings, take the time to review the eligibility criteria using resources offered by DHCD. This step helps avoid unnecessary delays due to misunderstanding housing regulations. - Gather Required Documentation:

Have all necessary documents at hand before beginning the application process. Ownership papers could be among the other location-specific required documentation. - Familiarize Yourself With the Filing System:

Utilize the instructions found on official government websites to aid navigation throughout the submission procedure. This is especially beneficial if unfamiliar system functionalities are involved.

So, what’s the takeaway? Staying in the loop with all shifts impacting real estate is crucial.

DCRA Proactive Safety Inspection

For the last and final step of acquiring your Basic Business License, you will need to set up an inspection with the DCRA. The DCRA will send an official inspector to your residential property in order to ensure that your property is up to code and up to DC’s safety standards for tenant move-in.

If you are a client of Nomadic Real Estate, we send our own representative alongside the DCRA inspector to document the results of the inspection. From there we utilize 12 years’ worth of relationships with local vendors to ensure that your home is up to city code and safety standards.

If you are considering whether or not to hire someone to manage your property, click here to get in touch. We would love to talk to you, and give you a free quote today!

Basic Business License DC: Recap

Getting your basic business license in DC is a crucial step in launching and maintaining any business within the city.

You’ve learned about the importance of the license and the steps required to obtain it, including the online application and fee payment.

We also discussed the Clean Hands Self Certification, which is a necessary part of the process. Additionally, it’s important to remember that you need to register with the Office of Tax and Revenue.

Furthermore, if you plan on renting out residential properties in DC, don’t forget to file for rent control or exemption.

All of these requirements may seem overwhelming, but with the right knowledge, they can be managed effectively.

If you’re in need of assistance navigating through this process, contact Nomadic Real Estate.

Our team specializes in Washington D.C. real estate transactions, including leasing, property management, and sales. We have a solid understanding of DC’s complex licensing requirements, including obtaining a basic business license.

Let us guide you on your journey to success!