With so many payment options available today, understanding the best ways to pay rent can be confusing. From traditional checks to online platforms and apps, each method offers different benefits and drawbacks when it comes to security, convenience, and fees.

In this blog, we’ll explore the most popular rent payment methods, helping you decide which option best fits your lifestyle and needs. The right payment method can significantly enhance the rental experience for both tenants and landlords in the DMV area.

Key Takeaways:

- Multiple Payment Options: Various methods like checks, money orders, online platforms, and mobile apps each offer distinct benefits and drawbacks.

- Security and Convenience: Digital options provide greater security and ease compared to traditional methods, enhancing the rent payment process.

- Costs and Fees: Some methods may involve additional fees, such as credit card payments, while others like checks may be fee-free.

- Automation for Timeliness: Automated payments through banks or online platforms help ensure timely payments and avoid late fees.

- Landlord Preferences Matter: It’s crucial to consider your landlord’s preferred payment methods and communicate to find the best solution.

Understanding Modern Rent Payment Options

The evolution of financial technology has significantly impacted rent payment methods. While traditional options remain viable, digital solutions are gaining popularity due to their efficiency and convenience.

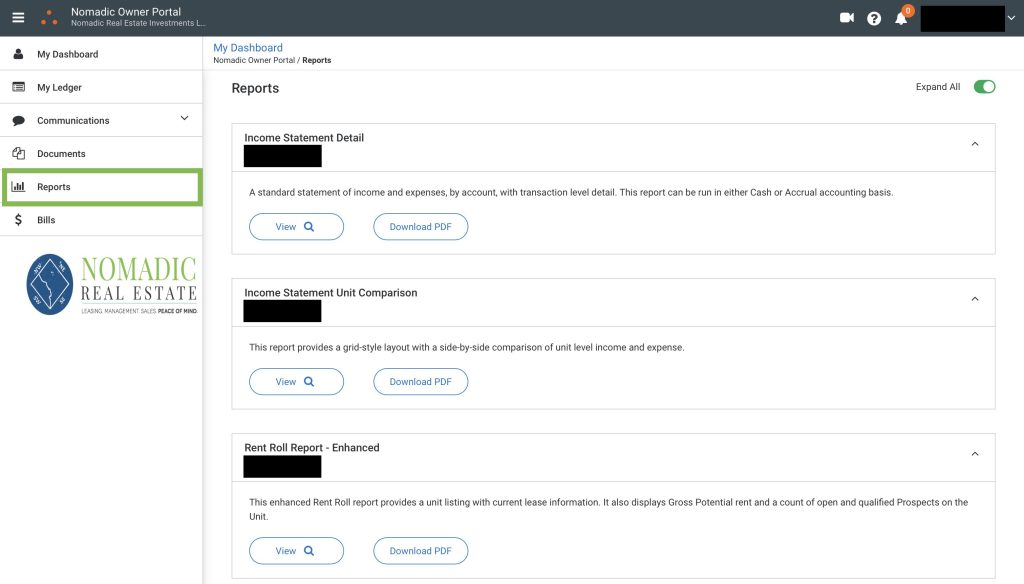

Online Rent Collection Platforms

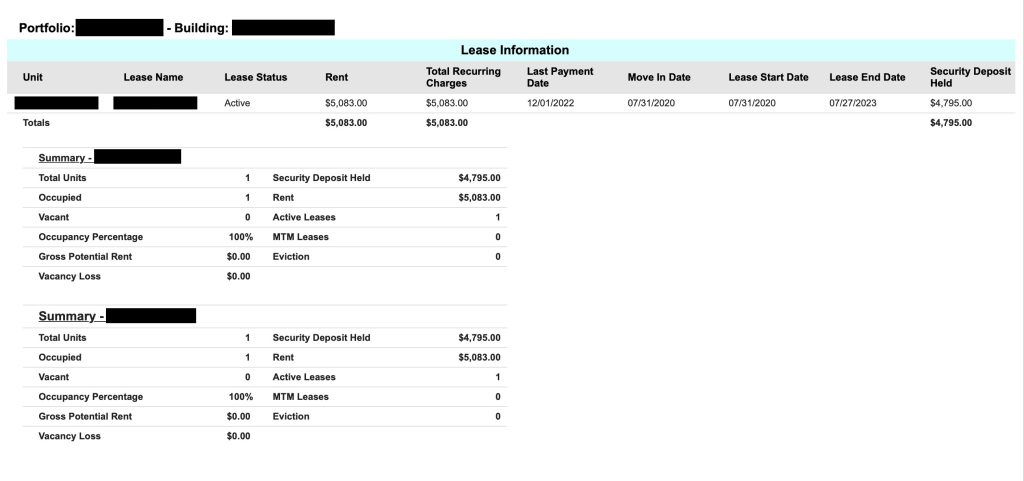

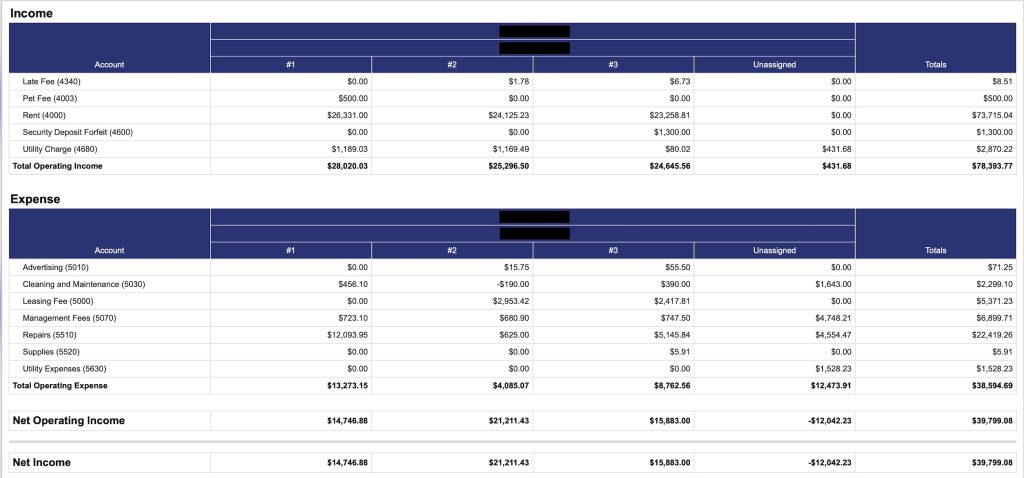

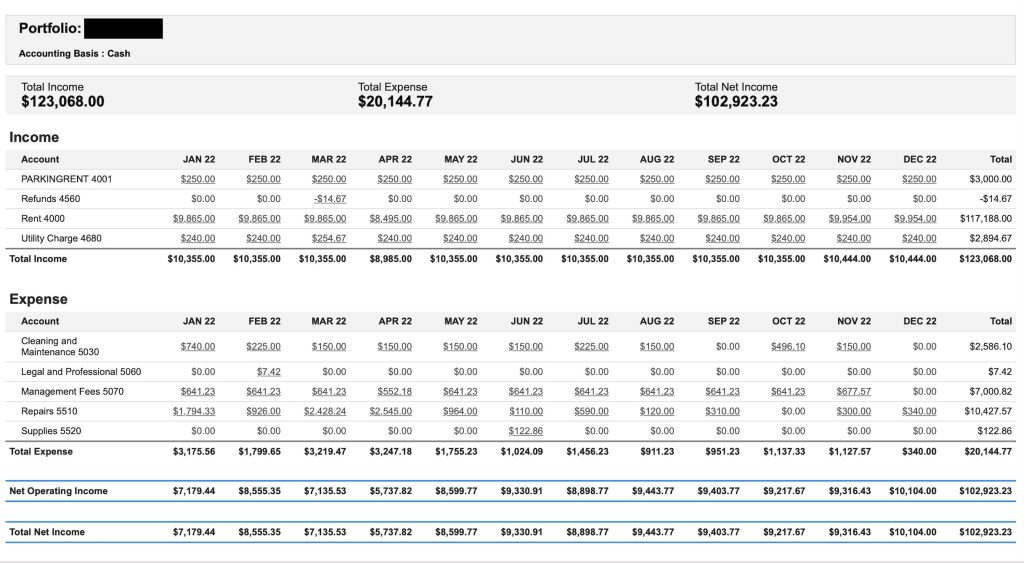

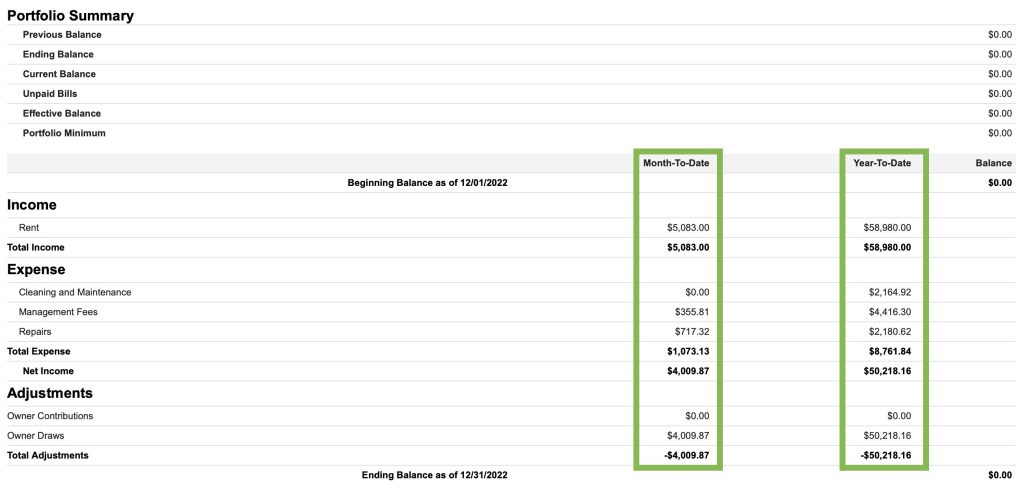

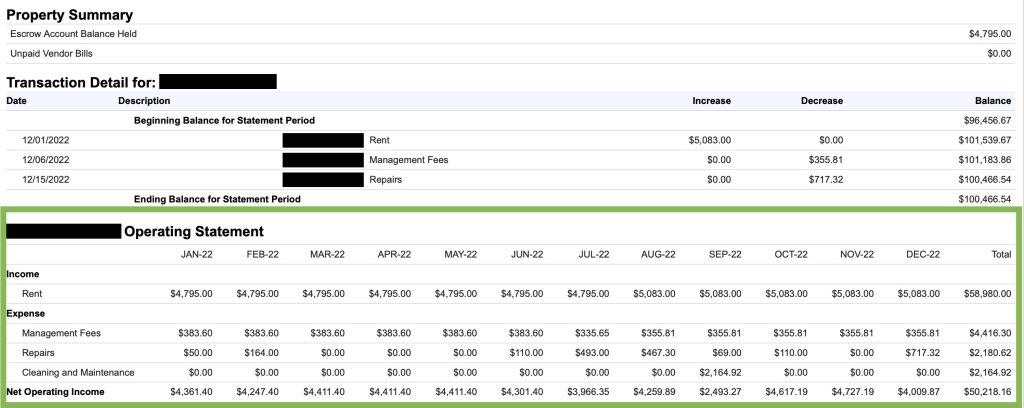

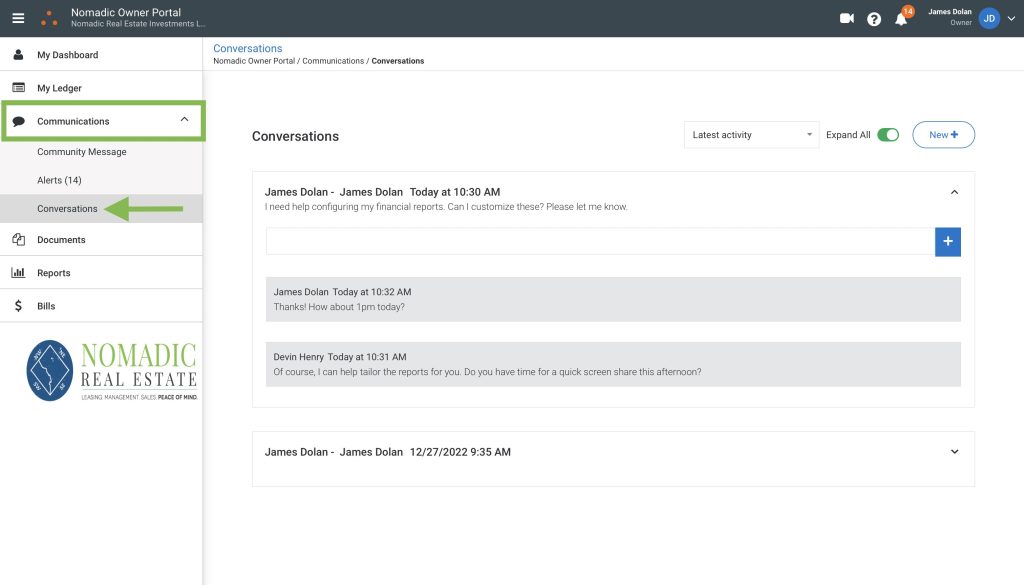

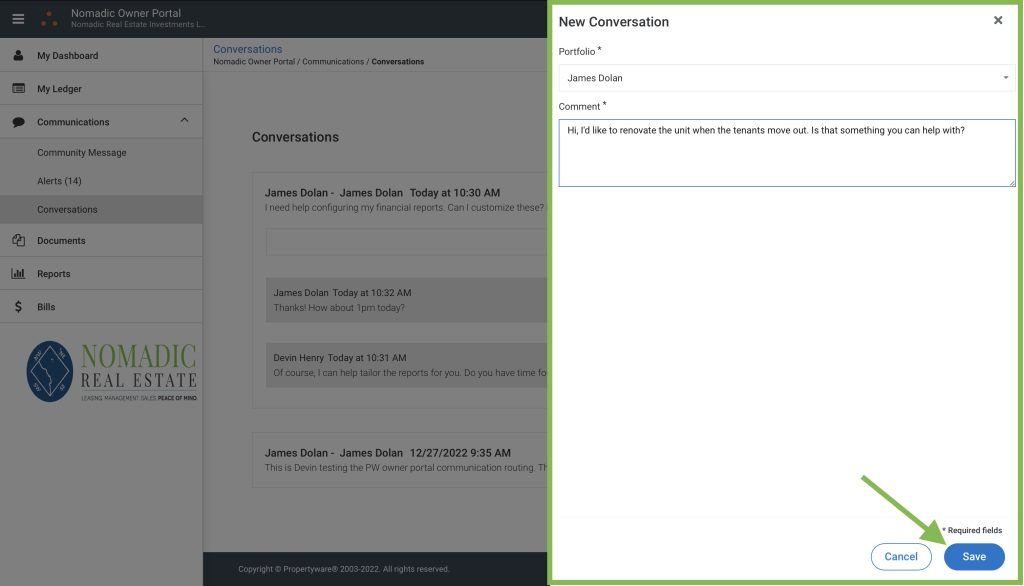

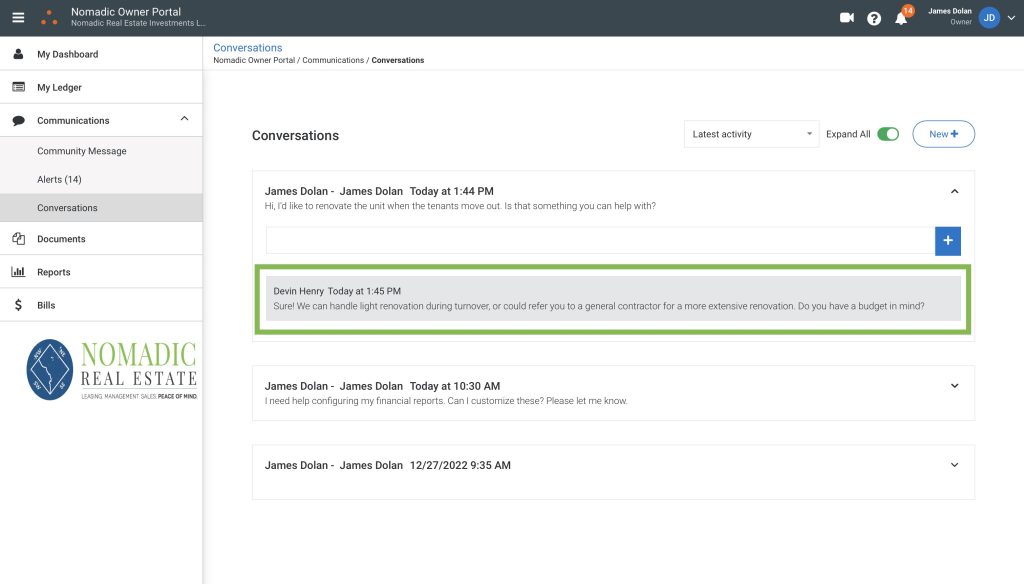

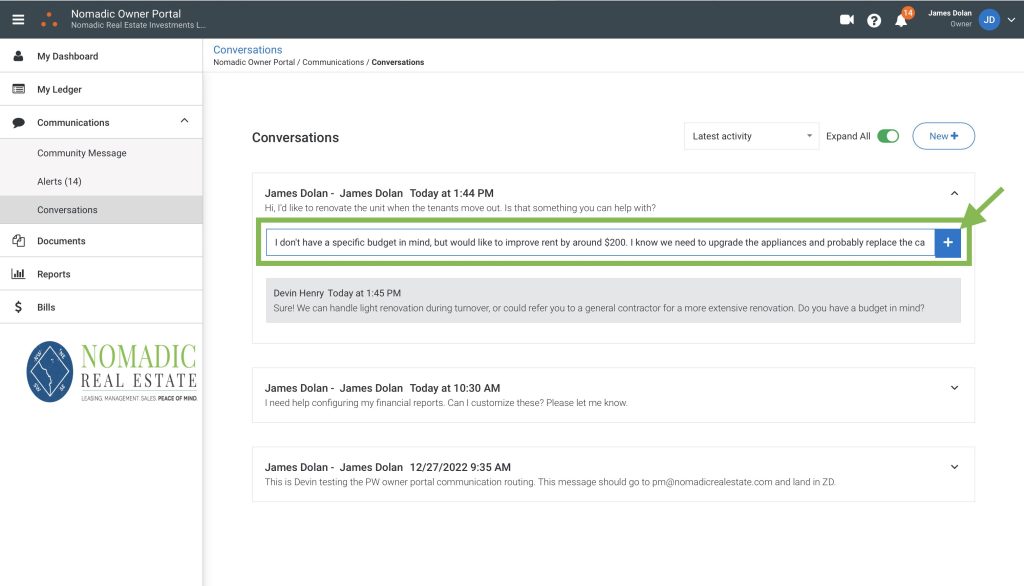

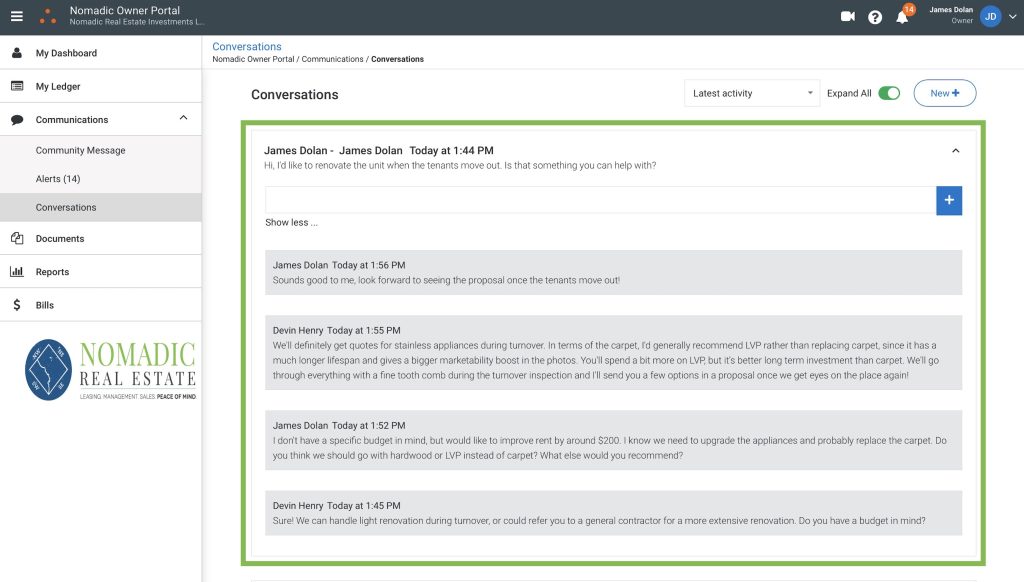

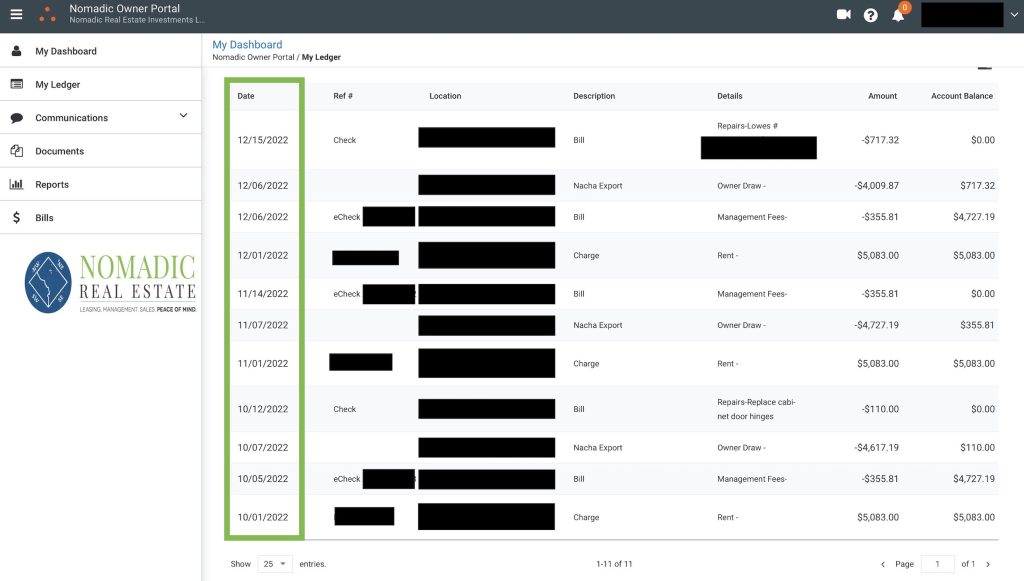

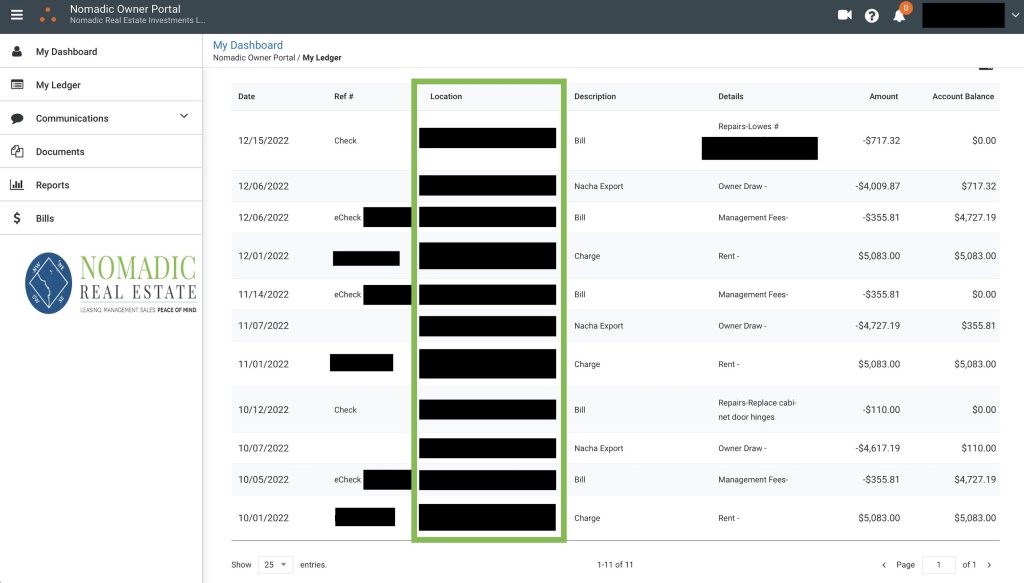

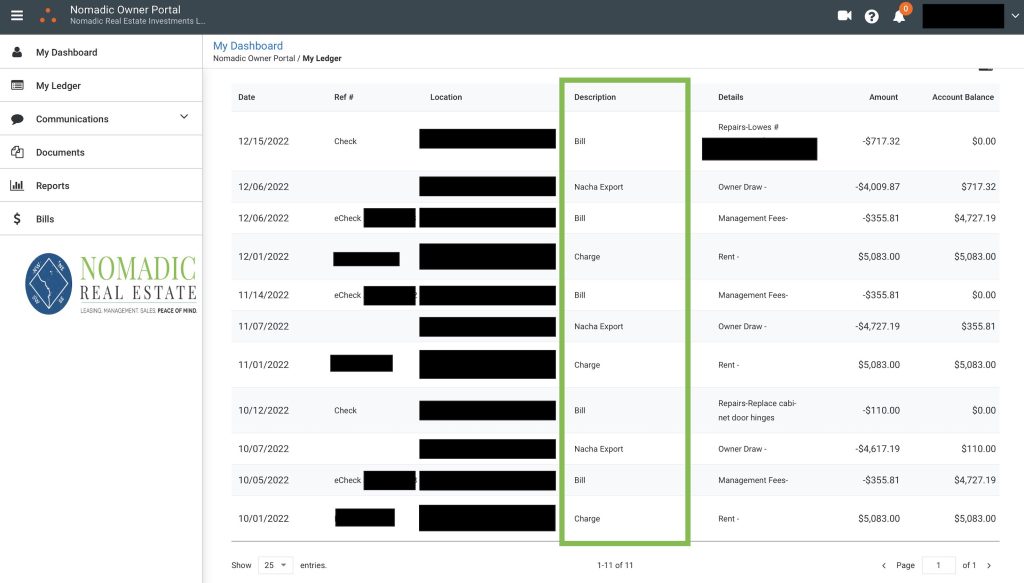

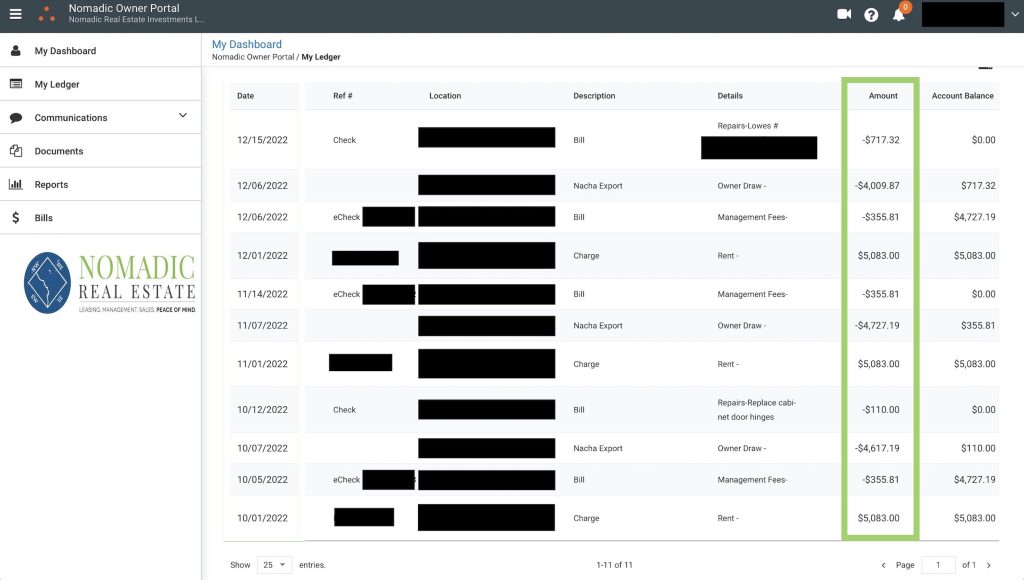

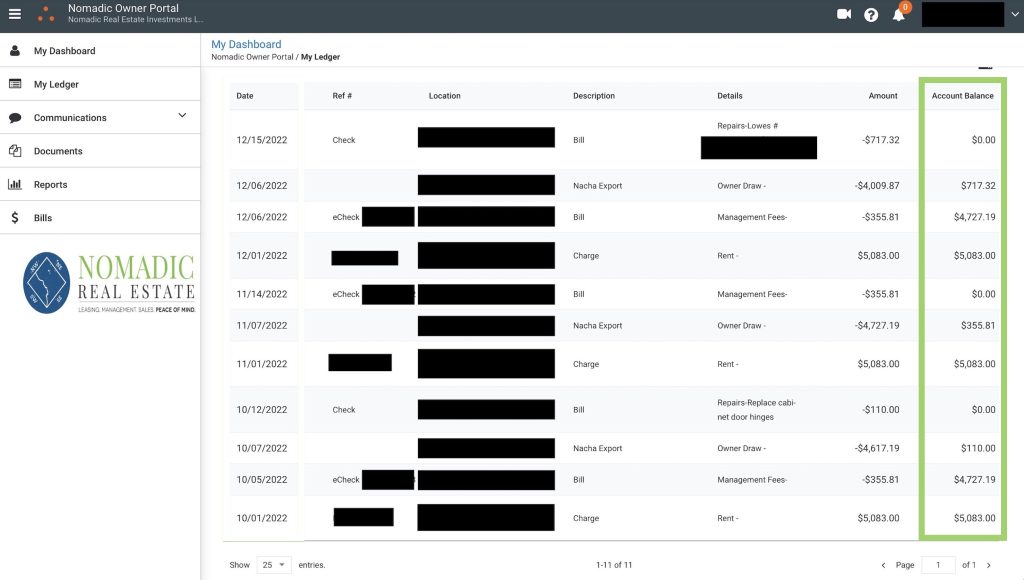

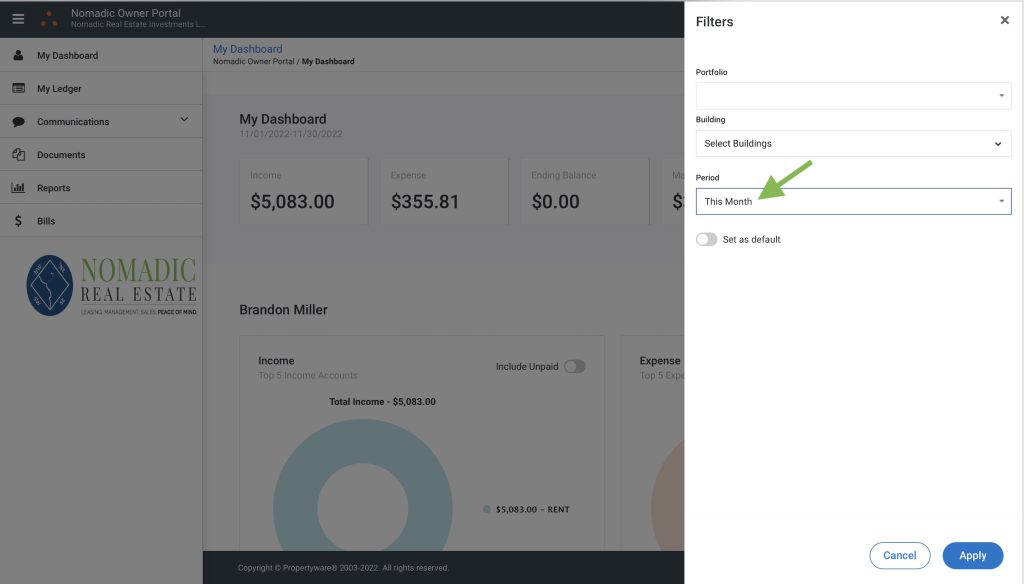

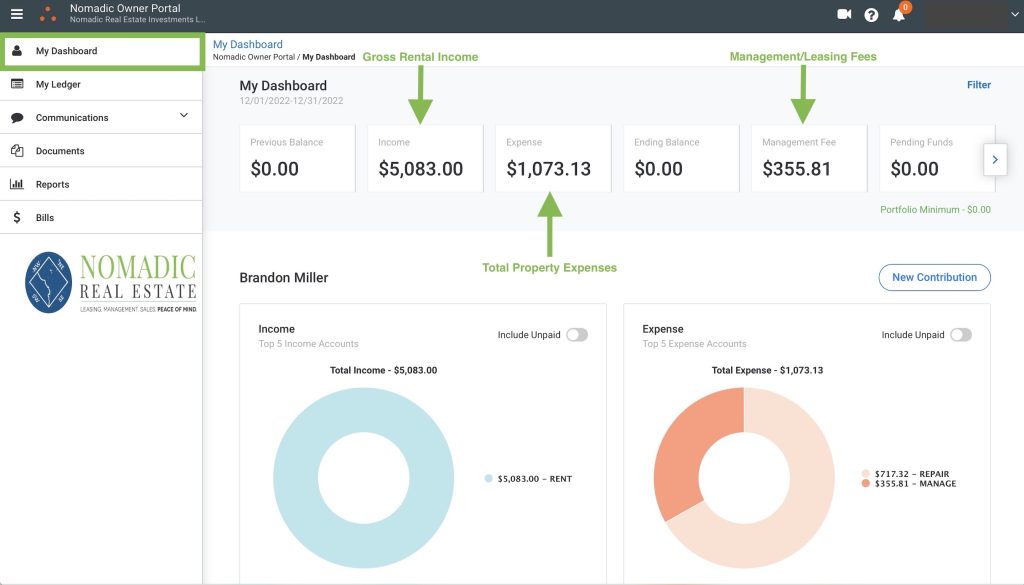

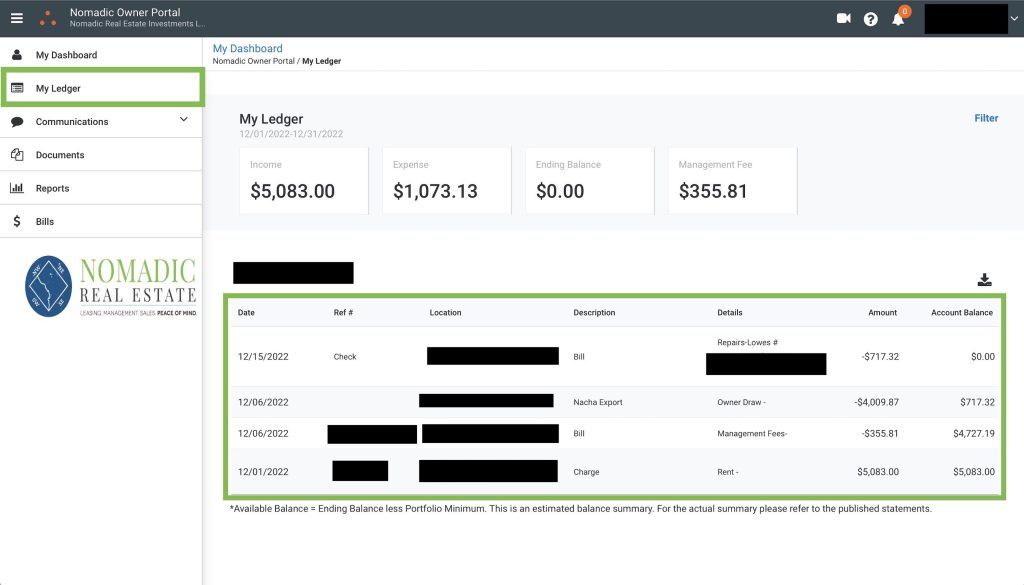

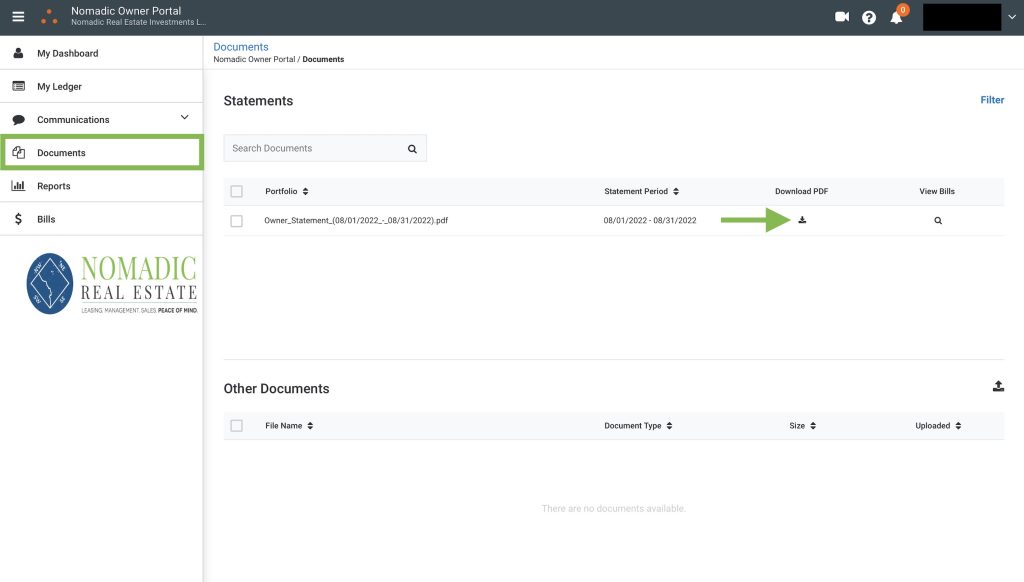

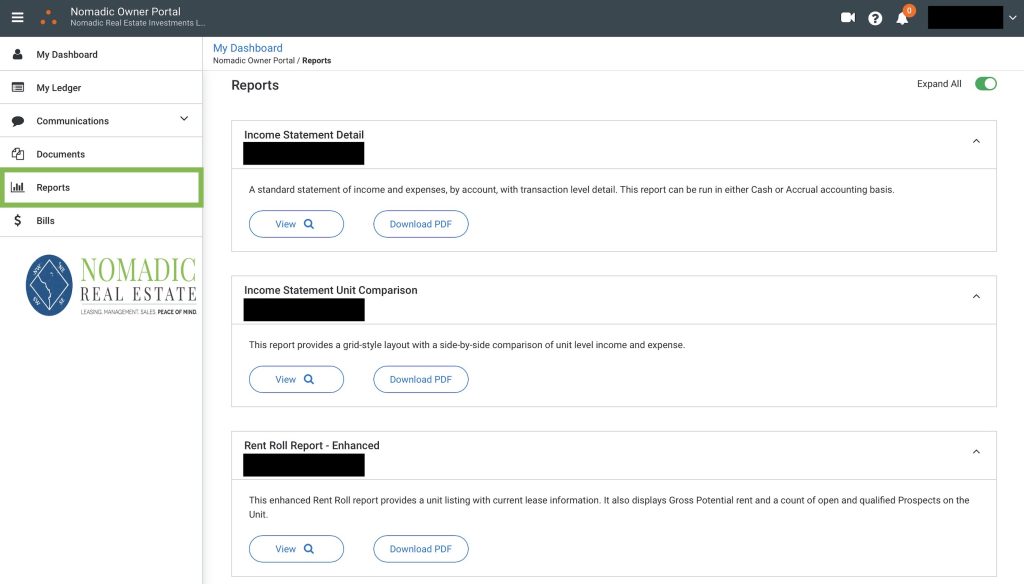

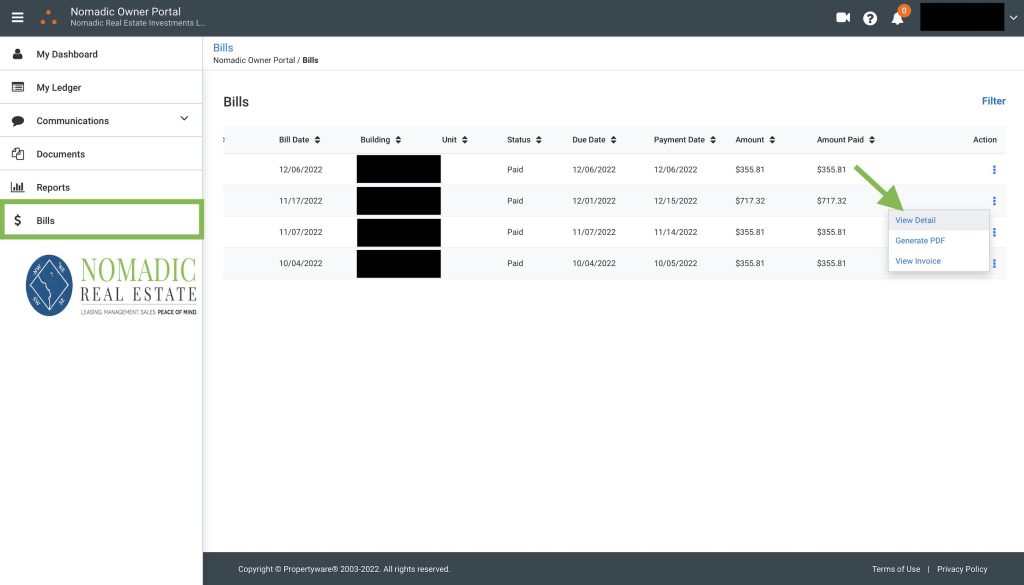

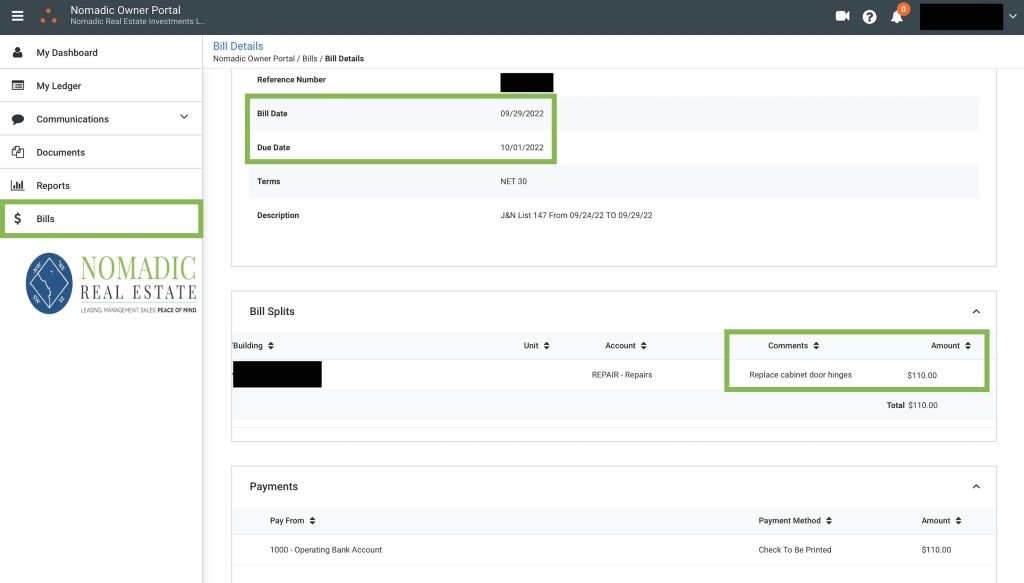

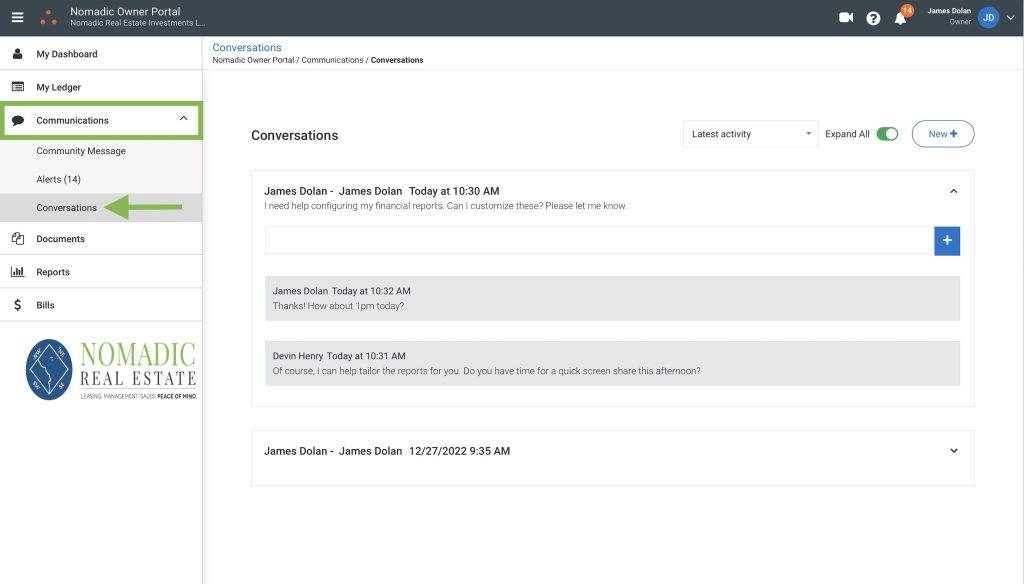

Online platforms designed specifically for rent collection offer a comprehensive solution for both tenants and landlords. These systems typically provide automated payment scheduling, detailed transaction records, and additional features such as maintenance request submissions.

PropertyWare, for example, is a leading platform that offers a suite of tools for property management, including online rent collection, lease management, and maintenance tracking.

Such platforms can streamline the rental process, from payment to property upkeep. While these platforms offer convenience, users should be aware of potential fees and the necessity of internet access.

Direct Bank Transfers as a Rent Payment Method

Direct bank transfers, including electronic funds transfers (EFTs) and Automated Clearing House (ACH) payments, offer a swift and efficient digital method for rent payments.

This approach typically processes within 1-2 business days and allows for recurring transfer setup, minimizing late payments. While it provides enhanced security by eliminating risks associated with physical payments, tenants must manage their accounts carefully to avoid overdraft fees.

Some banks may charge for inter-institution transfers, and privacy concerns may arise due to the need to share account information. Despite these considerations, the convenience and speed of direct bank transfers make them an increasingly popular choice for both tenants and landlords, provided users maintain diligent financial planning.

Mobile Applications for Rent Payments

Mobile payment applications have become increasingly popular for various transactions, including rent payments. These apps offer user-friendly interfaces and quick transaction processing.

Users should note that these applications may have transaction limits and fees. Additionally, some individuals may have concerns about the security of mobile payment platforms.

Traditional Rent Payment Methods

Checks as a Rent Payment Option

Despite the rise of digital alternatives, checks remain a common method for paying rent. They provide familiarity and wide acceptance, along with physical proof of payment. For landlords, checks offer a tangible record of transactions and can be easily deposited at most banks.

However, checks can be lost in transit and may have longer processing times compared to digital methods. Additionally, tenants must ensure sufficient funds are available in their accounts to avoid bounced checks, which can result in fees and strained landlord-tenant relationships.

Money Orders for Rent Payment

Money orders provide a secure alternative to personal checks. They offer guaranteed funds and don’t require a bank account, making them accessible to tenants without traditional banking services. Money orders also provide a paper trail for both parties, offering a level of security in case of payment disputes.

The main drawbacks include purchase fees and the inconvenience of obtaining them in person. Furthermore, if lost or stolen, money orders can be difficult and time-consuming to replace, potentially causing delays in rent payment.

Cashier’s Checks as a Secure Rent Payment Method

Cashier’s checks, issued by banks, provide a highly secure method of rent payment. They offer bank-guaranteed funds and increased security compared to personal checks. Landlords often prefer cashier’s checks for large payments, such as security deposits or first and last month’s rent, due to their reliability.

However, they typically involve fees and require an in-person visit to a bank to obtain. Additionally, while rare, cashier’s checks can be forged, so landlords should verify the check with the issuing bank for large transactions.

Credit Cards for Rent Payment

Some landlords accept credit cards for rent payments. While this method offers convenience and potential rewards, it’s important to consider the processing fees, often passed on to the tenant, and the risk of accumulating high-interest debt if not managed properly.

Credit card payments can be particularly useful for tenants in emergency situations or those who can pay off the balance immediately. However, landlords may be hesitant to accept credit cards due to the risk of chargebacks and the need for specialized payment processing equipment or services.

Factors to Consider When Choosing the Best Way to Pay Rent

When evaluating rent payment methods, several factors come into play. Landlord preferences and requirements often dictate available options, so it’s crucial to communicate with your property manager about acceptable payment methods. Transaction fees and associated costs can significantly impact your choice, especially for long-term tenants.

Payment processing time is another important consideration, particularly for those who need to ensure timely rent payments. Security features and fraud protection should be at the forefront of your decision-making process to safeguard your financial information.

The convenience and ease of use of a payment method can greatly affect your monthly routine, so consider how each option fits into your lifestyle. Lastly, robust record-keeping and payment tracking capabilities can prove invaluable for budgeting and potential dispute resolution.

FAQs About The Best Way to Pay Rent

What is the safest way to pay rent?

Electronic transfers through secure online platforms or bank-issued cashier’s checks are typically safest. These methods provide clear transaction records and reduce the risk of lost or stolen payments. Always use reputable services and protect your personal information for online transactions.

Can I avoid fees when paying rent?

Direct bank transfers and personal checks often come without additional fees. Some landlords may offer fee-free online payment options.

Discuss with your landlord about absorbing fees for credit card or third-party service payments. Consider the trade-off between fees and convenience when choosing a method.

How can I ensure my rent payment is always on time?

Set up automatic payments through your bank or an online rent payment platform. If not possible, set multiple reminders and consider paying a few days early to allow for processing time. Communicate promptly with your landlord if you anticipate any payment issues.

What if my landlord doesn’t accept my preferred rent payment method?

Discuss the benefits of your preferred method with your landlord, such as increased security or faster processing. Offer to guide them through unfamiliar digital methods.

Consider suggesting a trial period for a new payment method. If an agreement can’t be reached, you may need to adapt to an accepted method or reconsider your tenancy.

Determining the Optimal Rent Payment Method

The best way to pay rent varies depending on individual circumstances, landlord requirements, and personal preferences. Digital methods often provide the most convenience and efficiency, with online rent collection platforms and direct bank transfers emerging as popular choices.

However, traditional methods like checks or money orders may be preferable for those who value tangible payment records or have limited access to digital banking services.

Ultimately, the ideal rent payment method should align with both tenant and landlord preferences, provide reliable and timely payments, offer clear transaction records, minimize additional fees, and ensure the security of financial information.

Remember, as financial technologies evolve and personal circumstances change, it’s wise to periodically reassess your chosen rent payment method. Stay informed about new options and don’t hesitate to discuss alternatives with your landlord if you believe a different method could better serve both parties.

If you are a property manager and are looking for a solution to help tenants pay their rent, reach out today.