Owning a home is exciting. You’ve escaped the towering world of rental payments and purchased something that belongs to you! It’s something to be proud of, you can feel happy about it, and feel accomplished when it finally goes into your name. With that ownership comes responsibility. While you’re trading rental payments for mortgage payments, your mortgage is often lower than a rental payment and saves you plenty of money in the long run. That’s great! Today we’re here to discuss a few tips on how you can lower your mortgage rate.

1. Make a Larger Down Payment

If you’re in the process of buying a home, putting down a larger down payment can assist in lowering your monthly mortgage. While every loan is different, putting down at least 20% can make a great difference in how much you pay each month. If you’re not in a time crunch and you’re able to take the time to save up more money to put down, then it’s even better.

You may also have a family member that can gift a little extra money to you that you can use to increase your down payment. Talk with your lender about gift money, items you’re willing to part with that make bring in a little extra cash, and all of your potential options.

2. Reduce Your Mortgage Insurance

Before you completely get rid of your mortgage insurance, talk to your lender about reducing it. Most policies will allow you to pay the premium upfront at the closing, making the monthly payment vanish, but if you don’t have the resources to do that then you may be able to pay a little more than planned to help take that monthly stress away. This will offer temporary relief financially.

Additionally, if the seller is paying closing costs, you can ask for them to pay the mortgage insurance in one lump sum. Sellers won’t always agree to this, but you won’t know if you don’t ask.

3. Drop Your PMI

Some banks will allow you to skip out on private mortgage insurance if you put 20% down or if you’ve paid 20% of the loan. Once you’ve put enough money into the home and the market rises to give it more equity, you can ask your lender about dropping your mortgage insurance. Often if they’re willing to let you drop it, they’ll send an appraiser out to verify the value of your home. Once that appraiser reports back to your lender, you may see your mortgage rate drop.

4. Refinancing

You’ll have to pay a little money up front with this option, but it can benefit you greatly. Consider refinancing your mortgage to take advantage of a lower interest rate. You’ll need to know the market value of your home to show its equity, and you’ll have to pay refinancing closing costs, but this can lower your monthly mortgage rate by up to 1%.

5. Extend Your Repayment Term

Having a little extra time to make ends meet can be nice. It gives you a little breathing room and ensures that you’ll be able to pay your bills without getting too overwhelmed. If extending your repayment term sounds beneficial to you, call your lender to see if that’s an option. This is also known as re-amortizing and you may be able to go from a 12-year mortgage to a 24-year or even 30-year mortgage. This will reduce your monthly payments by spreading it out over a longer period of time. You’ll need to pay more interest in the long run, but it can be beneficial for quick financial relief.

6. Apply for Forbearance

Should you be hit with financial hardship, talk to your lender about a forbearance option. Make sure you do this before you miss a payment so they can help you. If they see it may help you out they may temporarily suspend your monthly payments or lower it to lighten the financial strain during this time. Once the set time frame is over your payments will resume like normal and you will have to make up for any missed payments in some way. This may be increasing your monthly payment a little each month to spread it out, or extending the repayment term.

7. Rent out Part of Your Home

For the second home, the home with an extra bedroom or basement, rent it out temporarily. That extra income can help make double the payments and will assist in paying off the full loan earlier. The little bit of additional money can help cover the costs of any needed repairs, offset your monthly payment, and provide a little breathing room financially. Often you can find a friend that needs a place to temporarily live, and even if you only charge them a percentage of your monthly rate it’ll help drastically.

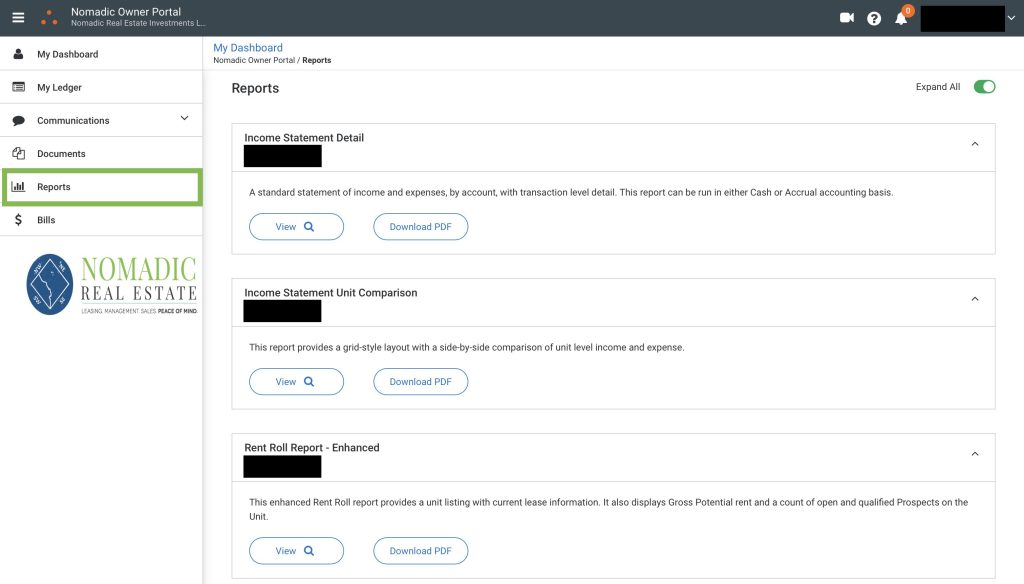

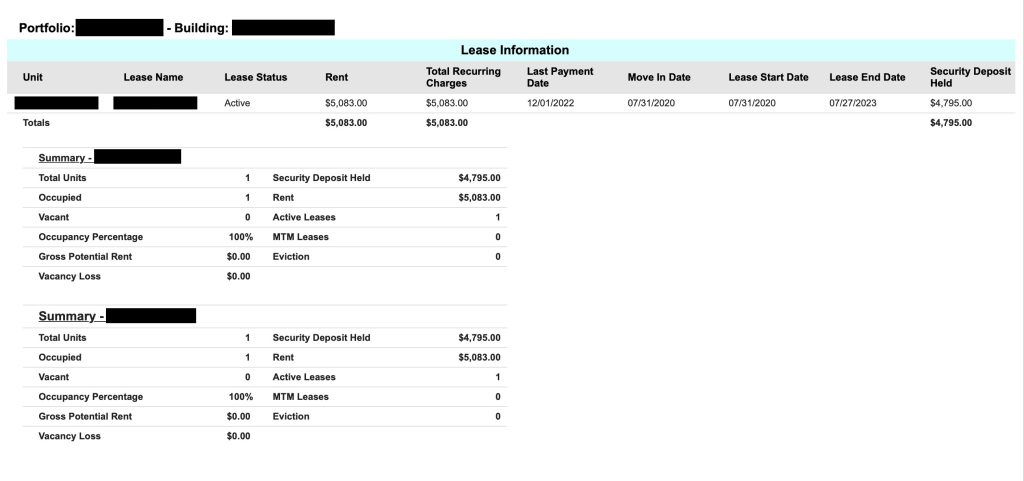

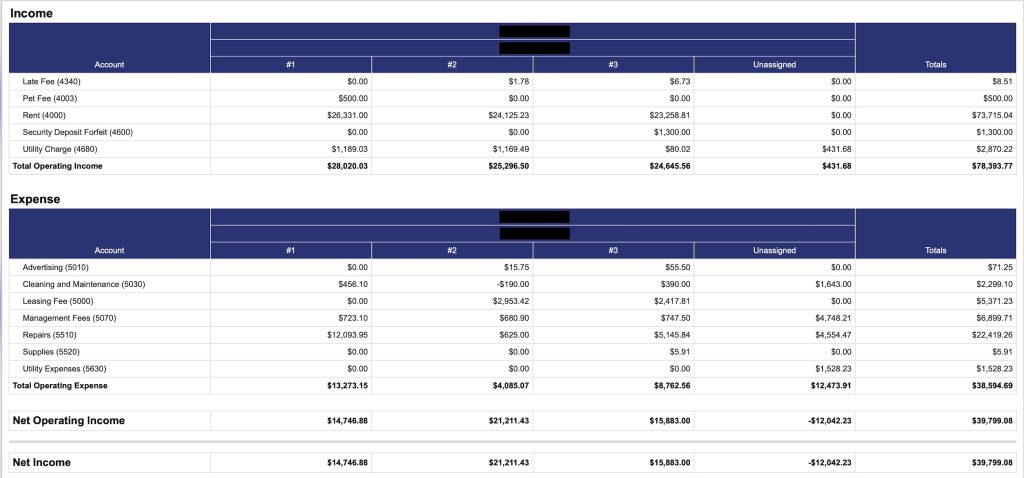

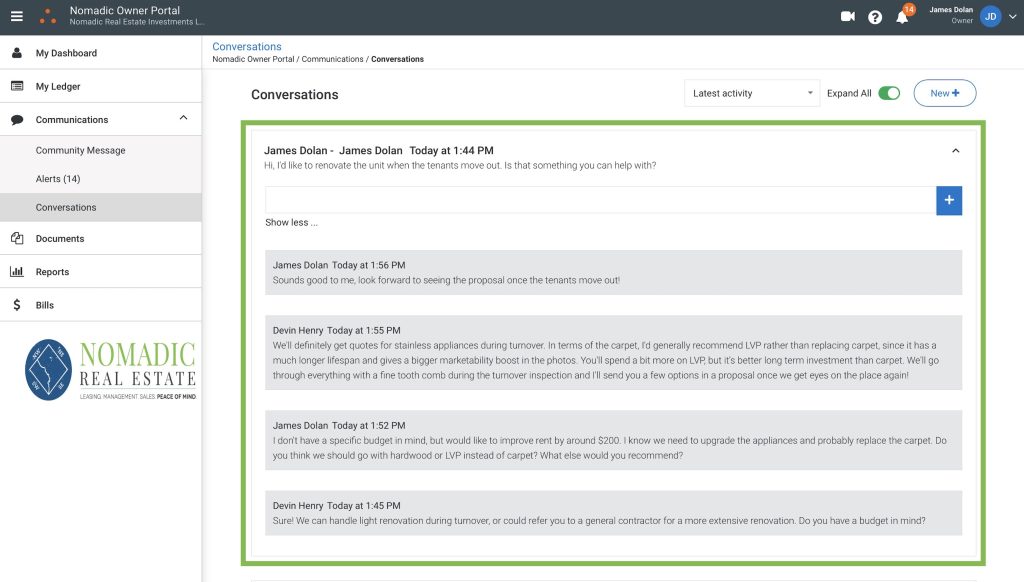

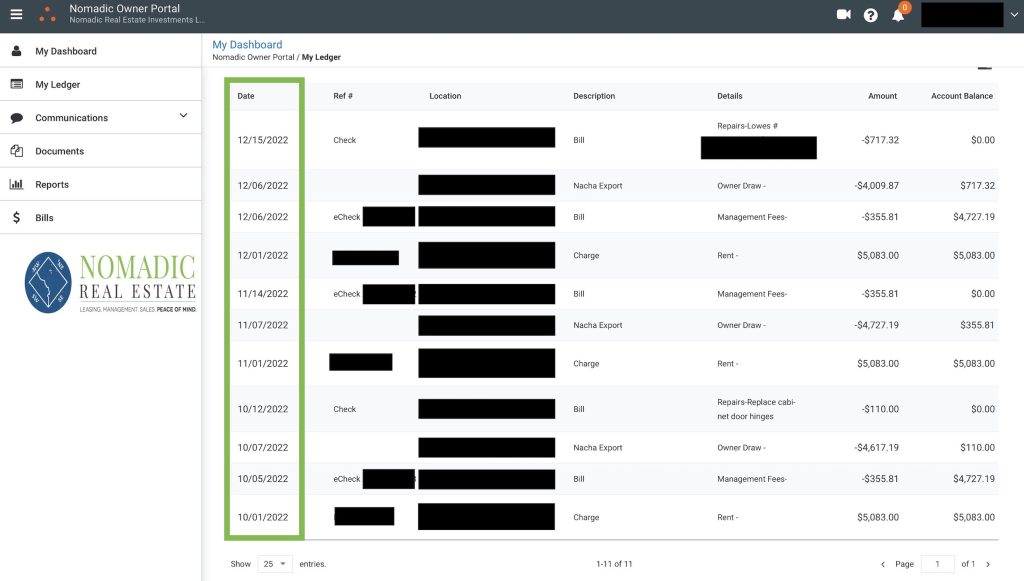

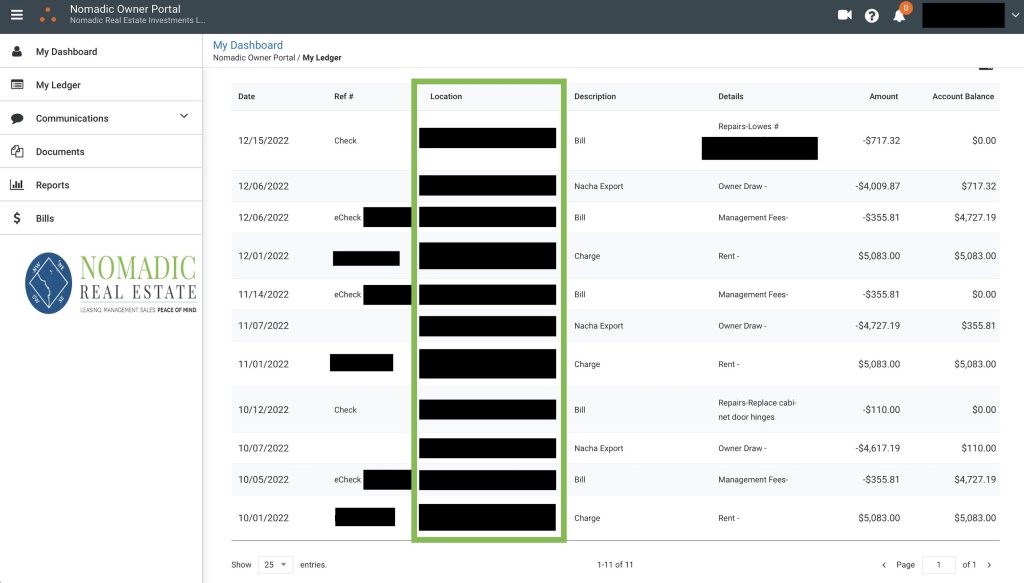

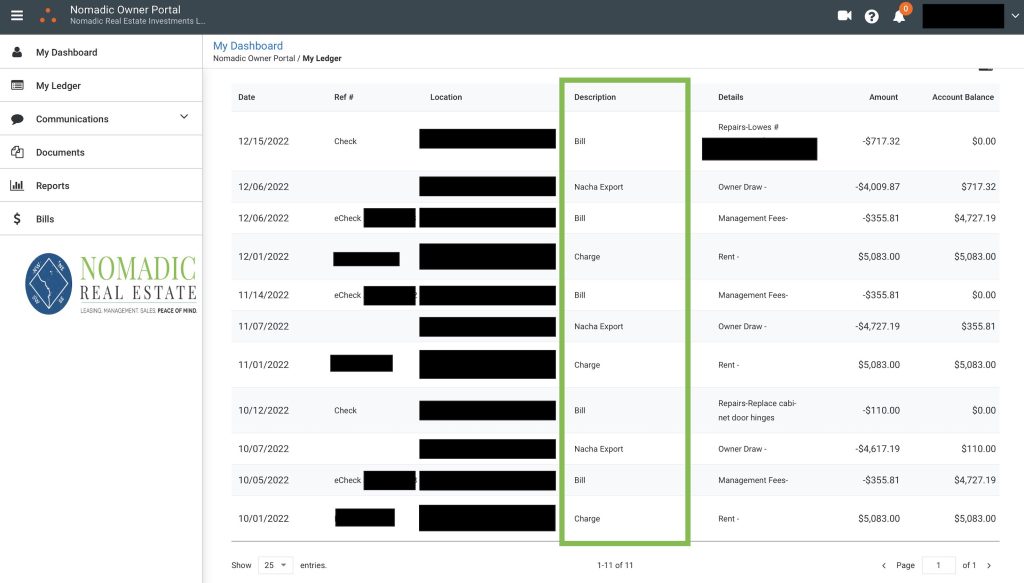

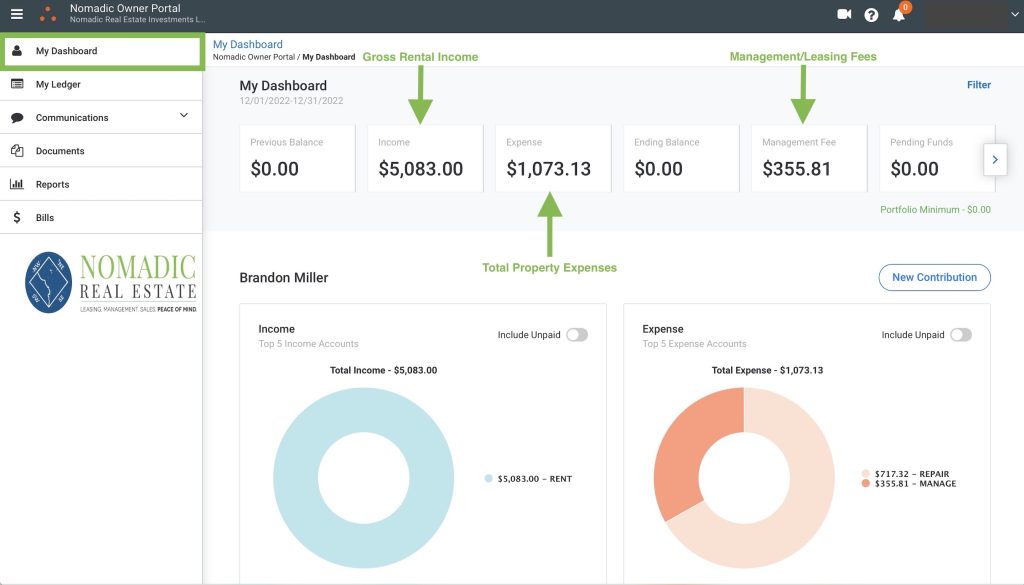

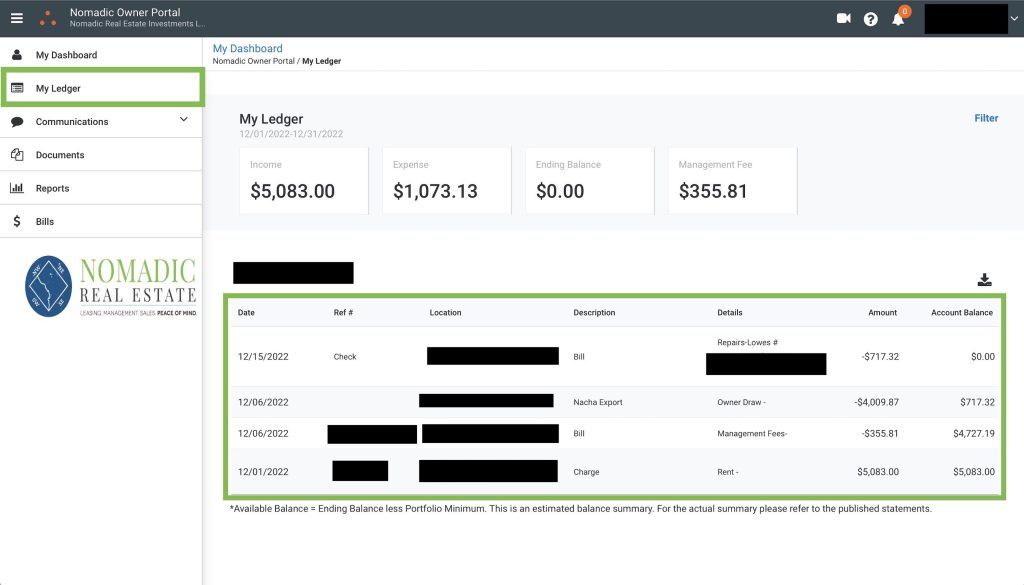

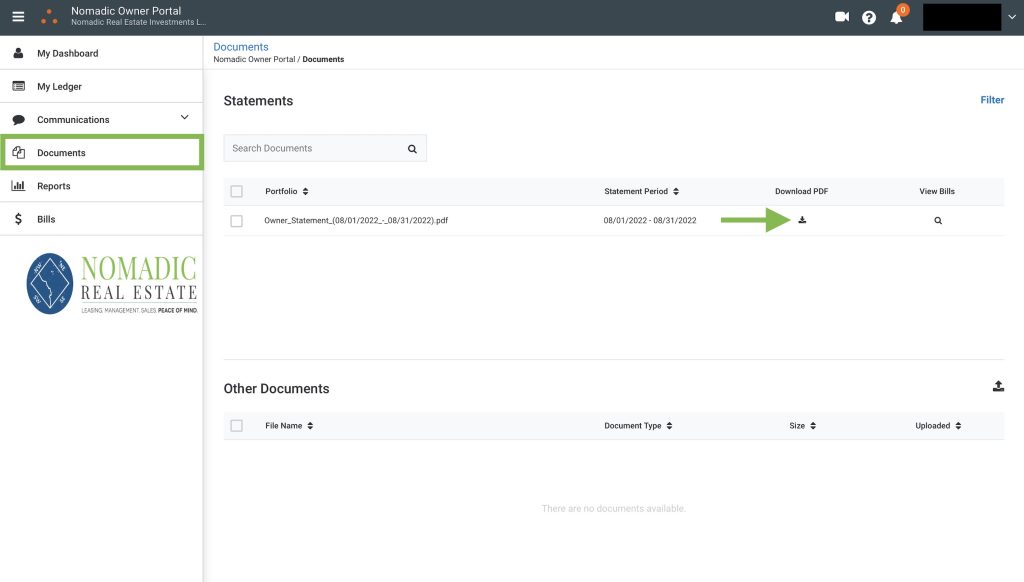

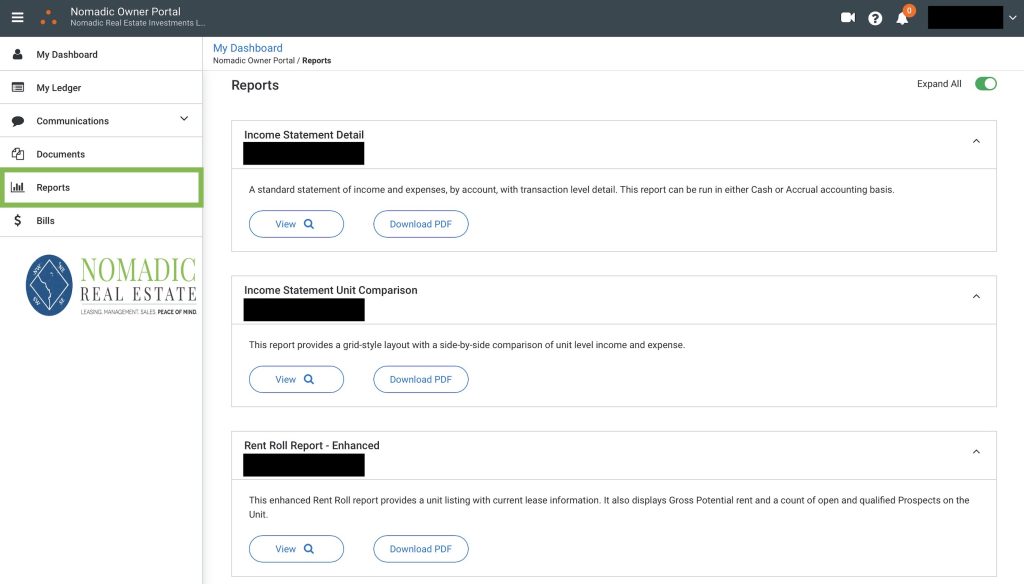

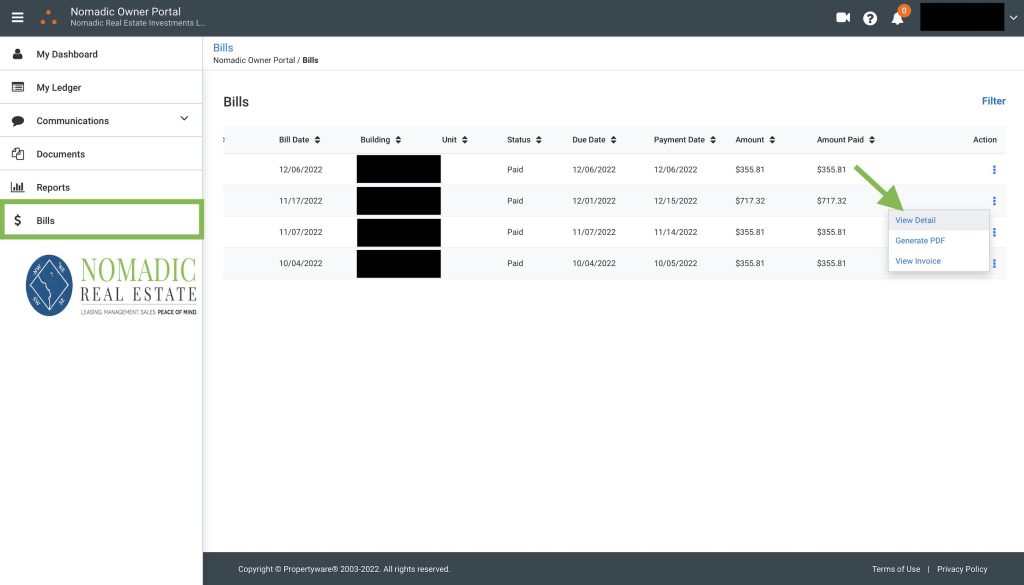

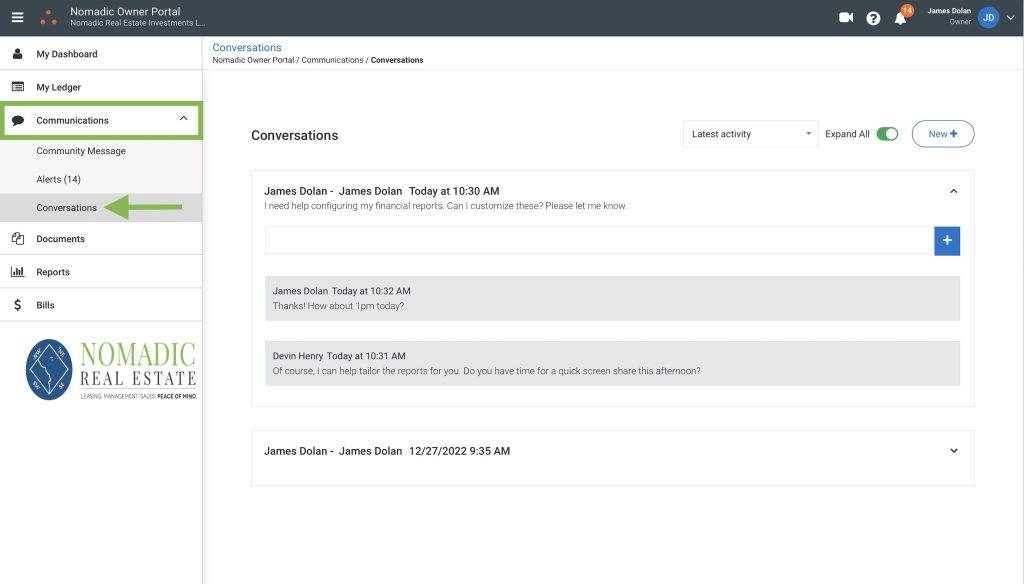

In the situation that you’ve never rented a property out to anyone, you can contact us at Nomadic Real Estate for your property management needs. There are no upfront fees and you only pay us when we’ve put a tenant in your home. We offer a 30-day guarantee with an approved tenant, 24/7 support in case of an emergency, and zero penalties should you decide to go a different direction.

Find More Ways to Lower Your Mortgage Rate

Our licensed team has over a decade of experience in the marketing world, and they’re more than happy to share that knowledge with you. Should you have any questions on the market, turning a home into a rental, finding the perfect tenants, or any general real estate question, we’re more than happy to help you.

When it comes to understanding mortgage rates and how to lock in the best one, we’ll connect you with the best lenders around to help make sure you get the lowest rate and have the most knowledgeable connection to help you in the future.

Get in touch with us today if you have any questions or concerns. We look forward to hearing from you and working in the near future.